glenwood springs colorado sales tax rate

Tax rates for glenwood springs. 1 2020 will impose a new tax of 20 cents per cigarette or 4 per pack on 20 cigarettes sold.

Alabama Sales Tax Rates By City County 2022

Assumes the local median home price and sales tax is amoritized over 13 years.

. Sales tax rates in Garfield County are determined by eight different tax jurisdictions Silt Rifle De Beque Parachute New Castle Garfield Glenwood Springs and Glenwood Sprgs Roaring Fork Rta. The Colorado sales tax rate is currently. Gold Hill CO Sales Tax Rate.

Future job growth over the next ten years is predicted to be 405 which is higher than the US average of 335. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Garfield County Colorado has a maximum sales tax rate of 86 and an approximate population of 37765.

Additional salesuse tax exemptions can be found at ColoradogovTax. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO. Tax Rates for Glenwood Springs.

State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs. The average sales tax rate in Colorado is 6078. Did South Dakota v.

The December 2020 total local sales tax rate was also 8600. Net taxable sales greater than 100000000 Service Fee reduced to. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is.

The Glenwood Springs sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements. 250 Total Tax rate with Accommodation Tax.

Gill co sales tax rate. Enter your income and we will give you your estimated taxes in Glenwood Springs Colorado we will also give you your estimated taxes in Gatlinburg Tennessee. To begin please register or login below.

Automating sales tax compliance can help your business keep compliant with changing. The County sales tax rate is. The minimum combined 2022 sales tax rate for Carbondale Colorado is.

Ballot Issue 2A asked Glenwood Springs voters whether or not taxes should be increased by up to 900000 annually in 2020 and by such amounts which may be generated annually thereafter. The Glenwood Springs Sales Tax is collected by the merchant on all qualifying sales made within Glenwood Springs Groceries are exempt from the Glenwood Springs and Colorado state sales taxes Glenwood Springs collects a 57 local sales tax the maximum local sales tax allowed under Colorado law. The US average is 73.

Method to calculate Glenwood Springs sales tax in 2021. Glade Park CO Sales Tax Rate. If you need assistance see the FAQ.

The 2018 United States Supreme Court decision in South Dakota v. The Carbondale sales tax rate is. CO Sales Tax Rate.

To review these changes visit our state-by-state guide. The County sales tax rate is. The tax which will take effect Jan.

Gill CO Sales Tax Rate. The Colorado sales tax Service Fee rate also known as the Vendors Fee is 0. This is the total of state county and city sales tax rates.

Glenwood Springs CO Sales Tax Rate. Gleneagle CO Sales Tax Rate. Glade park co sales tax rate.

An alternative sales tax rate of 86 applies in the tax region Glenwood Sprgs Roaring Fork Rta which appertains to zip code 81601. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. The estimated 2022 sales tax rate for 81601 is.

Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years. The sale of retail marijuana and retail marijuana products are exempt from the 29 state tax. Download a printable copy of the Glenwood Springs Registration Procedures and.

Gerrard CO Sales Tax Rate. MUNIRevs allows you to manage your municipal taxes licensing 24x7. The Colorado sales tax rate is currently.

This is the total of state county and city sales tax rates. The combined rate used in this calculator 86 is the result of the colorado state rate 29 the 81601s county rate 1 the glenwood springs tax rate 37 and in some case special rate 1. The current total local sales tax rate in Glenwood Springs CO is 8600.

The Glenwood Springs Colorado sales tax rate of 86 applies to the following two zip codes. Name Garfield County Treasurers Office Address 109 8th Street Glenwood Springs Colorado. The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104.

Gilcrest CO Sales Tax Rate. The combined amount is 820 broken out as follows. - The Sales Tax Rate for Glenwood Springs is 86.

Learn about sales tax rates sales tax returns and more. What is the sales tax rate in Glenwood Springs Colorado. Glen Haven CO Sales Tax Rate.

The sales tax is remitted on the DR 0100 Retail Sales Tax Return. The Colorado sales tax Service Fee rate also known as Vendors Fee is 00400 40 with a Cap of 100000. Glendale CO Sales Tax Rate.

Footnotes for county and special district tax. Sales Tax Rates in the City of Glenwood Springs. State Sales Tax The state salesuse tax rate is 29 with exemptions ABCDEFGHKLMNO P and Q.

Above taxes plus City Accommodation Tax.

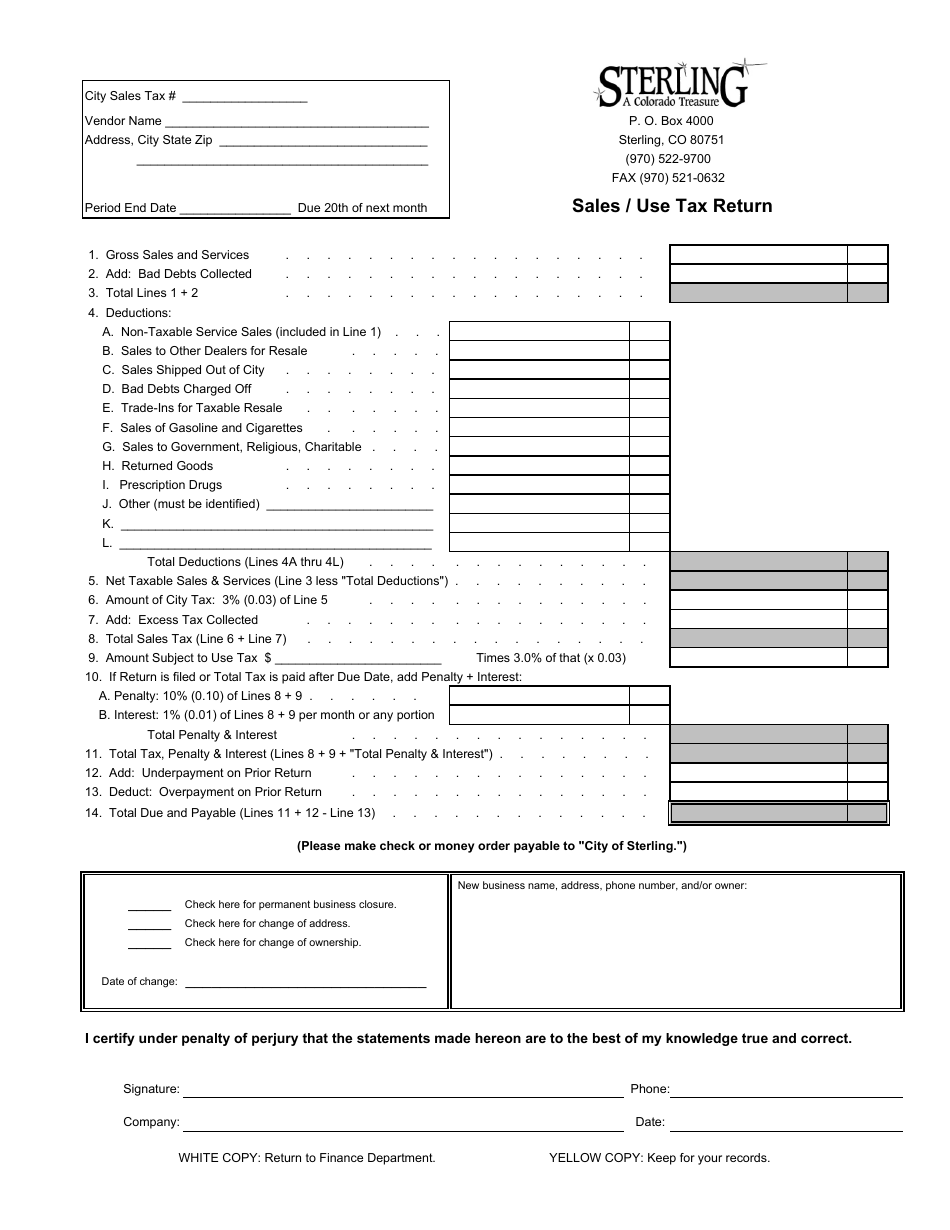

City Of Sterling Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

Georgia Sales Tax Rates By City County 2022

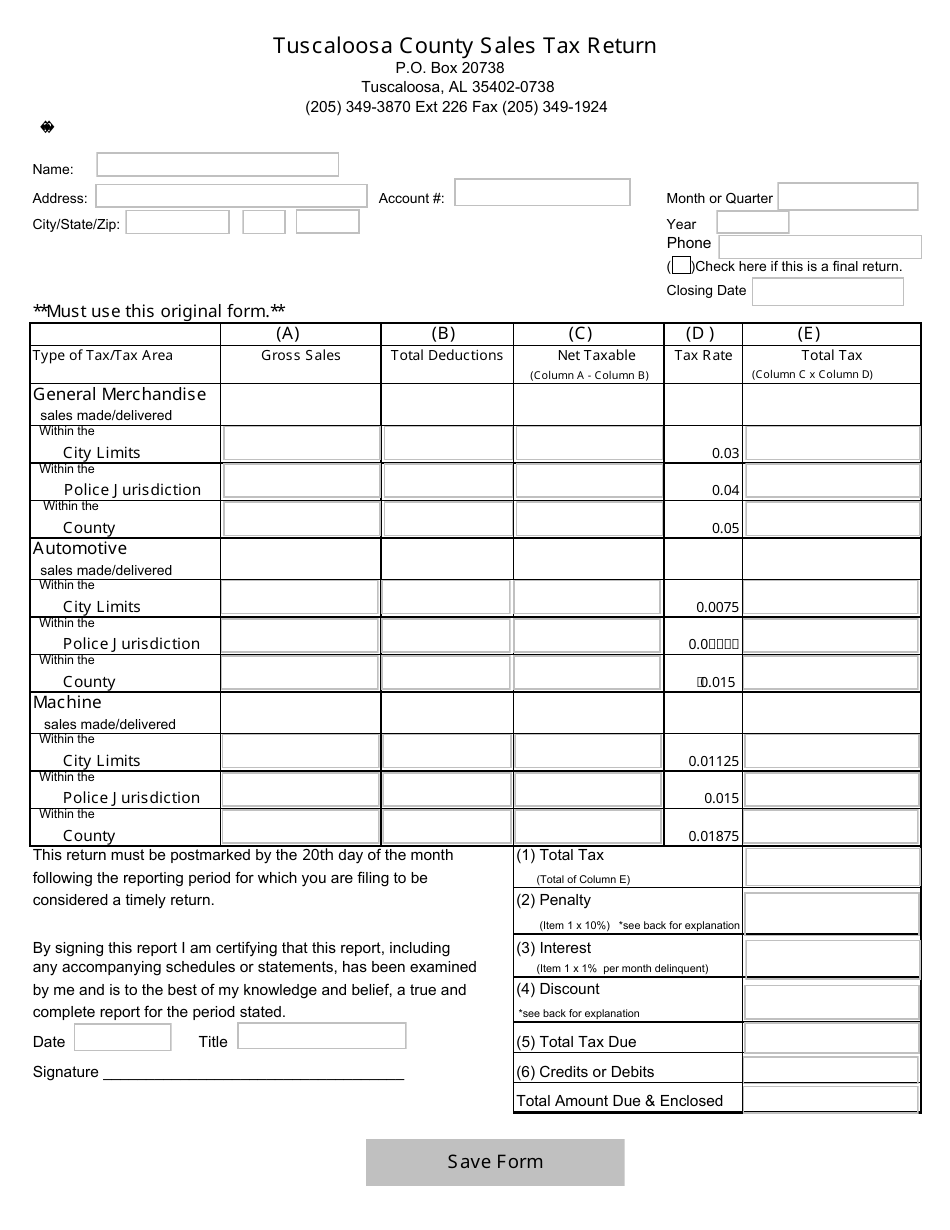

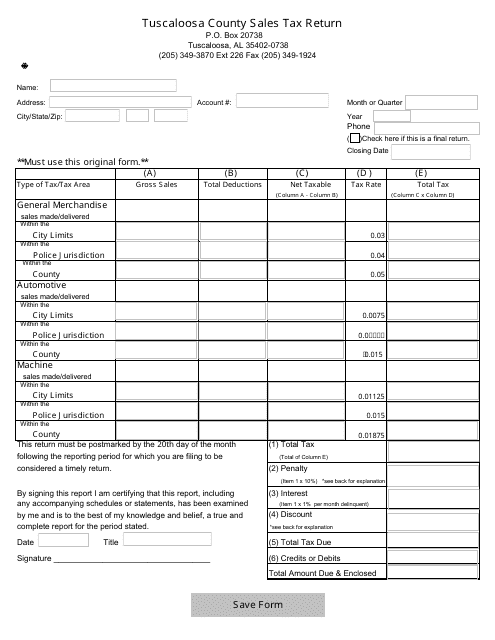

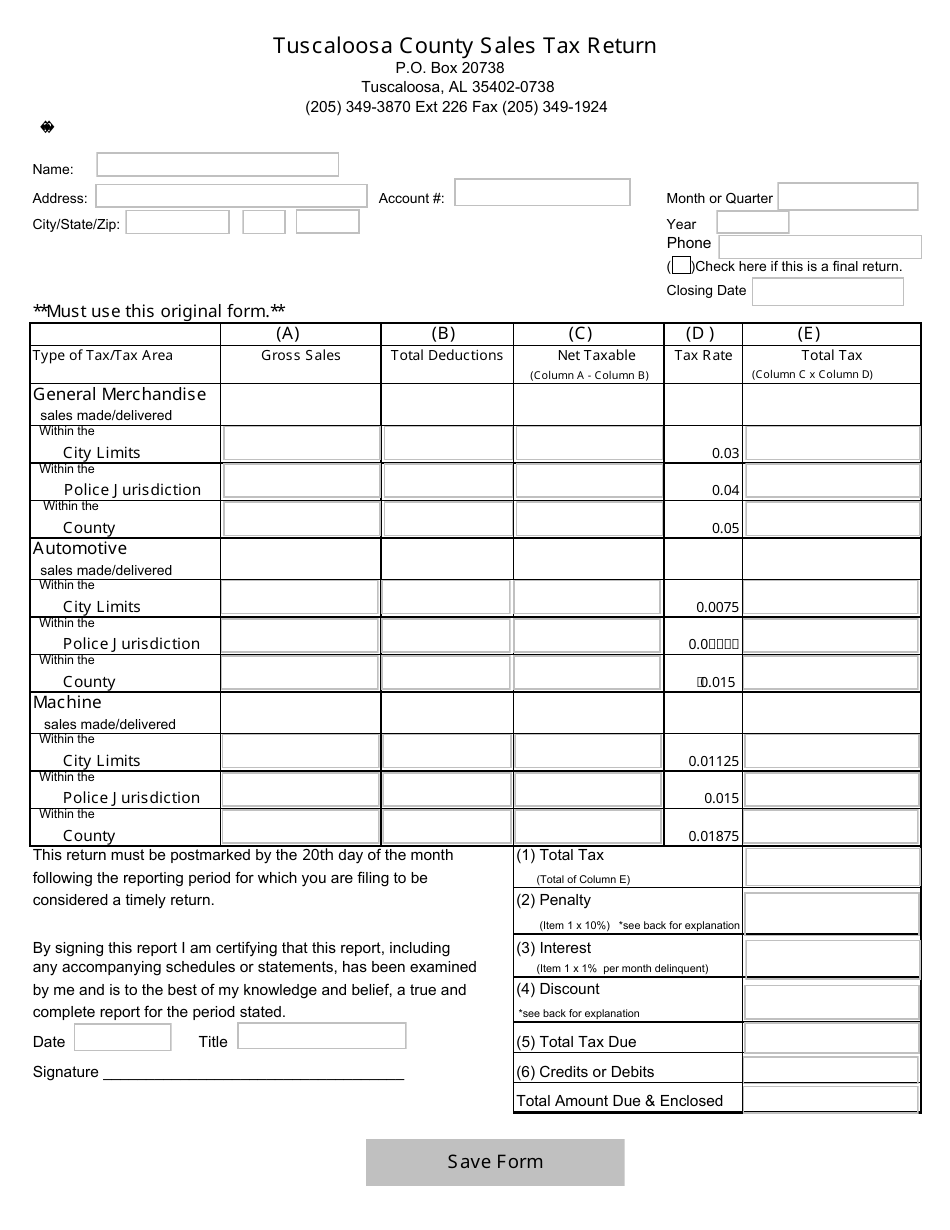

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Sales Tax Filing Information Department Of Revenue Taxation

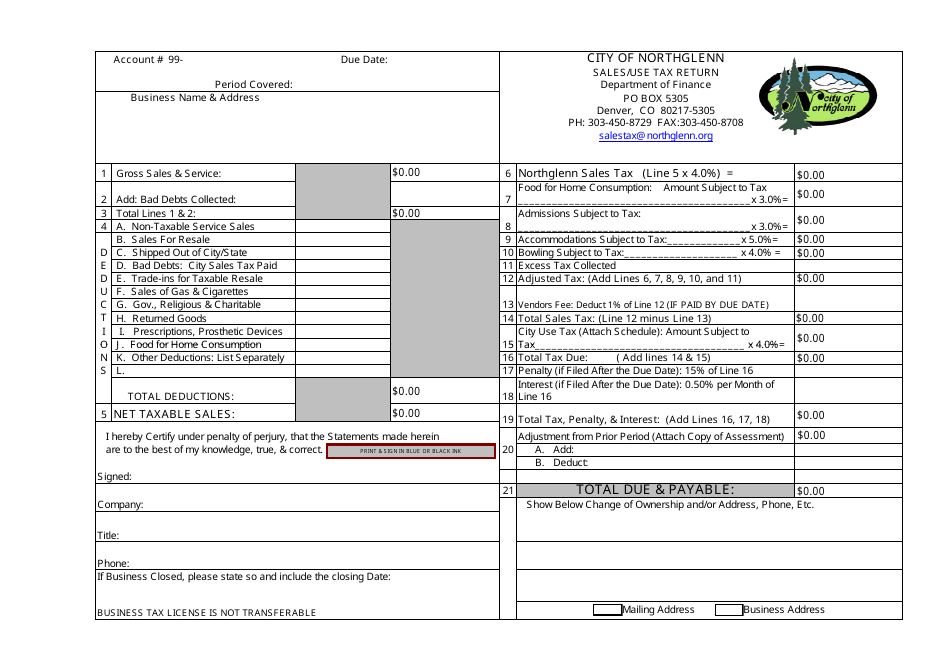

City Of Northglenn Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Florida Sales Tax Rates By City County 2022

Glenwood Springs Economy Is Strong As City Reports Sales Tax Collection Exceeded 2021 Forecast Aspentimes Com

Washington Sales Tax Rates By City County 2022

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Marijuana Sales Tax Department Of Revenue Taxation